Choose to invest in the future!

Today, you have the power to participate in the training of our students, who will become the actors of your success!

The apprenticeship tax is a tax payable by companies in order to finance the expenses necessary for the development of technological and professional training.

OMNES Education intends to strengthen its offer of schools and multidisciplinary programs, expand its educational innovations and open new campuses in France and Europe. This tax, collected from companies, thus contributes to the evolution of our mission and to the training of our future graduates.

Who pays it?

It is payable by any business of a commercial, industrial or artisanal nature, subject to income tax or corporation tax and employing at least 1 employee. Refer to service-public.fr

How do I pay the part of the balance (13%)?

Go to ta.omneseducation.com:

Our schools authorized to collect payments from companies as of right on the part of the balance are:

INSEEC Ile-de-France UAI 0754500J

INSEEC New Aquitaine UAI 0332524P

INSEEC Rhône-Alpes UAI 0694282E

ECE UAI 0754431J

EBS Paris UAI 0753636V

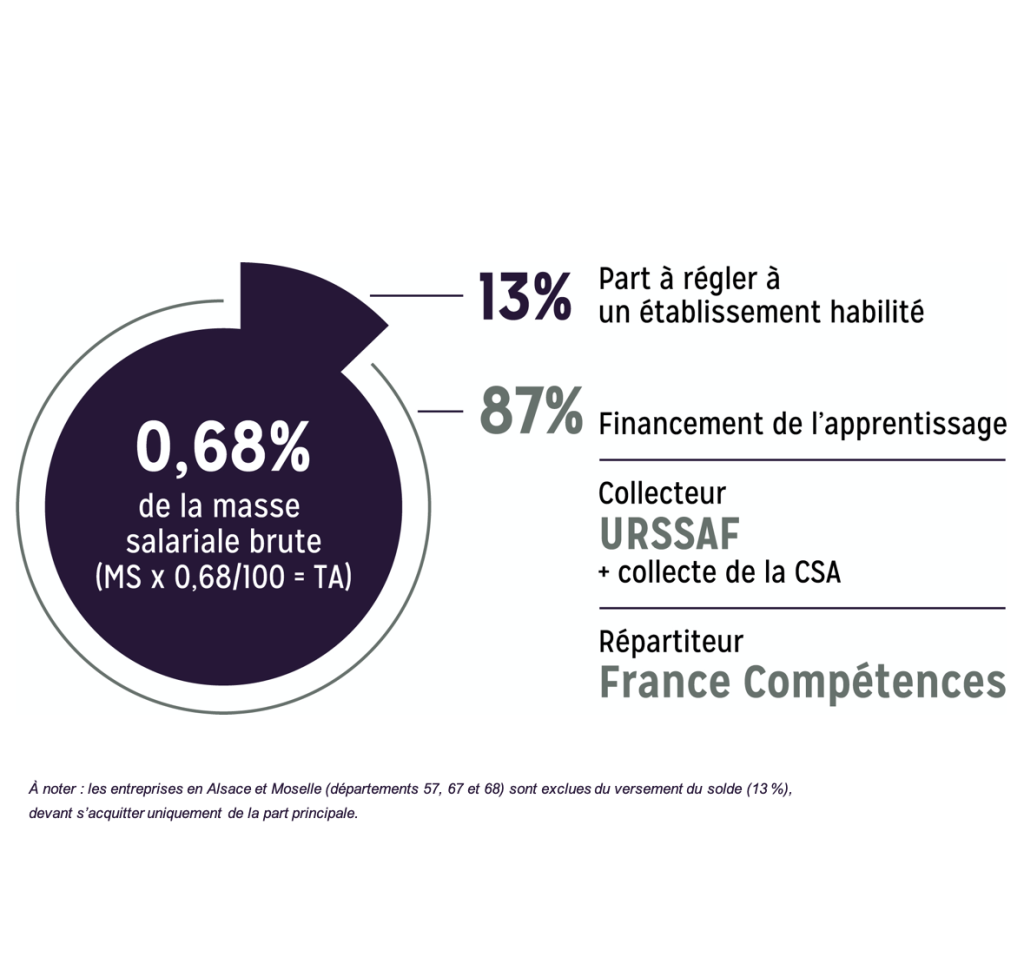

How is it calculated?

It is calculated on the basis of the amounts of wages subject to social security contributions and benefits in kind paid by the company over a calendar year (bonuses, bonuses, allowances, etc.). Its rate is set at 0.68% of payroll. vice-public.fr

Its distribution

It must be paid in 2 parts:

- The share of the balance (13%), intended for the expenses necessary for the development of initial technological and professional training (excluding apprenticeship)

From February 2022: the employer will declare and pay each month in DSN, according to the same terms as all social security contributions, this fraction with the URSSAF or MSA.

- The main part (87%) intended for the financing of work-study

The 2020 reform has modified the payment of this part, companies must pay this part directly to the establishments of their choice between JANUARY 1 AND MAY 31, 2022.

What happens to the funds received?

The funds received each year support the development of our teaching by allowing in particular:

– The opening of new campuses;

– The recruitment of teacher-researchers;

– Pedagogical innovation;

– The expansion of asynchronous training of multi-thematic online courses;

– The internationalization of our training;

– The financing of student projects & the development of entrepreneurial projects.

AN OMNES EDUCATION APPRENTICESHIP TAX SERVICE AT YOUR DISPOSAL

OMNES Education

Virginia Martin

43 Quai de Grenelle – 75015 Paris

Phone. : 01 53 92 03 41

Email: vmartin @asarrazinomneseducation-com

TO GO FURTHER, CALL ON US FOR YOUR RECRUITMENT

For your needs in terms of recruiting trainees, work-study trainees or young graduates,

you can send us your offers, we will distribute them to our network.